Weekly updates of the Newmarket Real Estate Market and relavent information for Home Owners, Home Buyers, Tenants, Landlords, and Business Owners.

Monday, December 12, 2011

Thursday, November 17, 2011

Canadian Home Sales Top Expectations

OTTAWA— The Canadian Press

Published Tuesday, Nov. 15, 2011 9:56AM ESTLast updated Tuesday, Nov. 15, 2011 10:20AM ESTcomments

The Canadian Real Estate Association says home sales in Ontario were stronger than anticipated during the third quarter — resulting in a slightly brighter outlook for CREA's 2011 and 2012 national forecasts.

The industry association is now projecting sales this year will be up 1.4 per cent from 2010, half a percentage point better than the previous forecast.

CREA expects there will be slightly fewer units sold next year than in 2011, but the 0.5 per cent decline is an upward revision.

October's sales activity through CREA members was the highest since January and the national average price was up 5.5 per cent from October 2010.

Source

Labels:

Aurora,

Coldwell Banker,

Darcy,

darcytoombs.com,

Market Data,

newmarket,

Toombs,

Toronto Real Estate,

TREB

Thursday, September 22, 2011

Should you Sell Your Home On Your Own?

Should you Sell Your Home On Your Own?

click on the link above.

for more real estate information, go to www.darcytoombs.com

click on the link above.

for more real estate information, go to www.darcytoombs.com

Wednesday, September 7, 2011

Carney keeps rate steady at 1% - British Columbia - CBC News

Carney keeps rate steady at 1% - British Columbia - CBC News

Bank of Canada keeps rates steady at 1%... good for the real estate Market!

____________________________________________________

For more Real estate Information, be sure to visit www.darcytoombs.com

Bank of Canada keeps rates steady at 1%... good for the real estate Market!

____________________________________________________

For more Real estate Information, be sure to visit www.darcytoombs.com

Tuesday, August 2, 2011

Newmarket's Urban Park is taking Shape

Friday, July 22, 2011

Know When it's Time to Renovate - TREB President's Toronto Sun Column

Toronto SUN Column (as it appears each Friday in the Toronto Sun)

July 22, 2011 -- Living in Toronto and renovating homes seem to go hand in hand. One of the major ways we build equity in our homes is by adding a new bathroom, kitchen or family room. Families grow, space must be maximized, and keeping parents close to work and children in their favourite schools often means, "Honey, It is time to renovate...again!"

Buying a fixer-upper can be a great way to get into a desirable neighbourhood at an affordable cost. It’s important to recognize though, that all renovations involve some inconvenience and a lot of elbow grease. While you’re rolling up your sleeves, it’s wise to maximize your efforts, go green, and remember that what may no longer suit your lifestyle, might be of use to someone else.

Renovating Benefits Others as Well!

A great way to renovate for you while supporting a charitable cause is to consider your local Habitat for Humanity ReStore. This building supply store accepts and resells quality new and used building materials. Funds support Habitat's building programs while reducing the amount of used materials that are headed for overflowing landfills. Check ReStores out online at http://www.habitat.ca/en/community/restores/location.

Regardless of the upgrades you undertake, keep in mind that you can reduce the amount of waste you generate by donating or recycling construction materials. Certainly don’t dismiss the old for the new, if there are items to be reused, refurbishing them can add greater character to your home.

If you are looking for some great tubs and sinks you may have to go no further than your current bathrooms and kitchens. Techniques for resurfacing and countertops made of more recent materials like Caesar Stone, recycled glass, concrete, steel, stones, and the myriad of tiles will give you lots of options for upgrading the look without replacing the whole bathroom or kitchen.

Paint and paint techniques can change the look of a kitchen in a few afternoons, save you money and improve your investment: The Appraisal Institute of Canada says that upgrading kitchens and bathrooms is a smart choice, potentially offering a 75 to 100 per cent return.

Greening your Renovations!

Energy efficient lighting, appliances, faucets, toilets and showerheads are a few of the options for increasing the green factor in these two essential rooms and you can watch your monthly expenses drop.

When it comes to flooring, cork and bamboo are among the greenest options, as they are derived from renewable resources. While bamboo is also an excellent choice for cabinets, wood that is certified by the Forest Stewardship Council of Canada is another responsible option.

Visit the Appraisal Institute of Canada’s RENOVA, an interactive web-based guide to the value of home improvements. RENOVA is designed to give consumers a better idea of the return on investment they can expect for a variety of home improvements.

Household drafts will increase your heating bills and make those lovely spacious rooms an expensive proposition in our colder months. Window and door replacement may offer a more limited return of 50 to 75 per cent, but if your existing units are broken or have been installed for fashion rather than performance, this upgrade should take priority.

When purchasing windows, look for low-E argon-filled units with the Energy Star symbol to achieve the highest thermal efficiency. Note: if you wonder how old your thermo pane windows are, most are stamped with the year and month they were made on the metal piece between the panes of glass.

Similarly, replacing an aging roof may only offer a small return but it’s an upgrade that should not be deferred due to the potential for water damage. Fortunately, roof shingles made from a variety of recycled materials are widely available and sometimes the life expectancy of your new roof is worth paying the extra costs. Housing is a long term investment.

Heating systems can offer a 50 to 75 per cent return, while central air conditioning can deliver 25 to 75 per cent on your investment, but given the extreme temperatures of our climate, these are also wise investments, particularly when you choose models with the Energy Star symbol. We replaced our workable 60 percent efficiency furnace with a high efficiency furnace that, with our new windows and doors keeps us toasty all winter.

While decorating choices may be subject to taste, you’ll find that when it’s time to move again, energy efficient, money-saving upgrades have universal appeal. Renovating can be helpful to you, others, and reduce your carbon footprint all at the same time. Enjoy!

For Greening, Renovating or finding the right home, talk to a Greater Toronto REALTOR® and visit www.TorontoRealEstateBoard.com for neighbourhood profiles, open house listings, market updates and more.

Richard Silver is President of the Toronto Real Estate Board, a professional association that represents 31,000 REALTORS® in the Greater Toronto Area.

Buying a fixer-upper can be a great way to get into a desirable neighbourhood at an affordable cost. It’s important to recognize though, that all renovations involve some inconvenience and a lot of elbow grease. While you’re rolling up your sleeves, it’s wise to maximize your efforts, go green, and remember that what may no longer suit your lifestyle, might be of use to someone else.

Renovating Benefits Others as Well!

A great way to renovate for you while supporting a charitable cause is to consider your local Habitat for Humanity ReStore. This building supply store accepts and resells quality new and used building materials. Funds support Habitat's building programs while reducing the amount of used materials that are headed for overflowing landfills. Check ReStores out online at http://www.habitat.ca/en/community/restores/location.

Regardless of the upgrades you undertake, keep in mind that you can reduce the amount of waste you generate by donating or recycling construction materials. Certainly don’t dismiss the old for the new, if there are items to be reused, refurbishing them can add greater character to your home.

If you are looking for some great tubs and sinks you may have to go no further than your current bathrooms and kitchens. Techniques for resurfacing and countertops made of more recent materials like Caesar Stone, recycled glass, concrete, steel, stones, and the myriad of tiles will give you lots of options for upgrading the look without replacing the whole bathroom or kitchen.

Paint and paint techniques can change the look of a kitchen in a few afternoons, save you money and improve your investment: The Appraisal Institute of Canada says that upgrading kitchens and bathrooms is a smart choice, potentially offering a 75 to 100 per cent return.

Greening your Renovations!

Energy efficient lighting, appliances, faucets, toilets and showerheads are a few of the options for increasing the green factor in these two essential rooms and you can watch your monthly expenses drop.

When it comes to flooring, cork and bamboo are among the greenest options, as they are derived from renewable resources. While bamboo is also an excellent choice for cabinets, wood that is certified by the Forest Stewardship Council of Canada is another responsible option.

Visit the Appraisal Institute of Canada’s RENOVA, an interactive web-based guide to the value of home improvements. RENOVA is designed to give consumers a better idea of the return on investment they can expect for a variety of home improvements.

Household drafts will increase your heating bills and make those lovely spacious rooms an expensive proposition in our colder months. Window and door replacement may offer a more limited return of 50 to 75 per cent, but if your existing units are broken or have been installed for fashion rather than performance, this upgrade should take priority.

When purchasing windows, look for low-E argon-filled units with the Energy Star symbol to achieve the highest thermal efficiency. Note: if you wonder how old your thermo pane windows are, most are stamped with the year and month they were made on the metal piece between the panes of glass.

Similarly, replacing an aging roof may only offer a small return but it’s an upgrade that should not be deferred due to the potential for water damage. Fortunately, roof shingles made from a variety of recycled materials are widely available and sometimes the life expectancy of your new roof is worth paying the extra costs. Housing is a long term investment.

Heating systems can offer a 50 to 75 per cent return, while central air conditioning can deliver 25 to 75 per cent on your investment, but given the extreme temperatures of our climate, these are also wise investments, particularly when you choose models with the Energy Star symbol. We replaced our workable 60 percent efficiency furnace with a high efficiency furnace that, with our new windows and doors keeps us toasty all winter.

While decorating choices may be subject to taste, you’ll find that when it’s time to move again, energy efficient, money-saving upgrades have universal appeal. Renovating can be helpful to you, others, and reduce your carbon footprint all at the same time. Enjoy!

For Greening, Renovating or finding the right home, talk to a Greater Toronto REALTOR® and visit www.TorontoRealEstateBoard.com for neighbourhood profiles, open house listings, market updates and more.

Richard Silver is President of the Toronto Real Estate Board, a professional association that represents 31,000 REALTORS® in the Greater Toronto Area.

for more eral estate information, go to www.darcytoombs.com

Labels:

Aurora,

Coldwell Banker,

House,

Main Street,

newmarket,

Renovation,

Sales,

Toombs,

Toronto Real Estate,

TREB

Tuesday, July 12, 2011

The York Region School Board has put 2 Old School up for sale

Both Schools are located in the beautiful old historic Neighbourhoods of each town and leave some neighbours anxious to know who will be buying them, as the Real Estate Values in these sections of town are highly in demand.

On the YRDSB website, ther is a news release stating that the Wells Street school that was built in 1892 has been out of service since 2007 for Structural deficiencies. There is no mention why the King George School is being sold or why it has gone out of service.

for more real estate information, go to www.darcytoombs.com

Tuesday, June 7, 2011

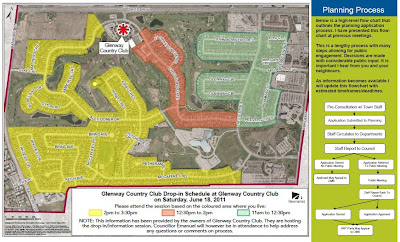

Glenway Information Sessions Planned

For all those who know Newmarket, you know that the sale of Glenway Golf and Country Club to a developer has been a hot button issue for the past few years. Now with services at the club being scaled back and some even cancelled, it is believed that there will soon be an announcement as to what is happening with the course.

Newmarket's Ward 7 Councillor, Chris Emmanuel, has been taking a very direct approach with the community to keep them up to date with what is going on.

This morning at 9:45am, I, along with the others on his email recipient list, received a bulk email from Chris informing me of the information sessions that the Owners of Glenway will be hosting on Saturday June 18th at Glenway Golf and Country Club.

It is their intent to have this session with residents about the development concept, where they will take residents comments.

Above is a map and indication on the times at which they would like to visit with certain sections of the Glenway community.

I'm not entirely sure if this will be a drop in session for all Newmarket Residents, as this is not a Town of Newmarket event, but rather an event hosted by the New Owners of Glenway.

However, to stay up to date with all that is going on with Glenway, go to http://www.chrisemanuel.com/ to sign up for his email notificatations.

Labels:

Darcy,

GTA,

home,

House,

Market Data,

newmarket,

Toombs,

Toronto Real Estate,

TREB

Friday, May 20, 2011

Wednesday, May 18, 2011

Wednesday, April 27, 2011

Know what to Look for in a Condo

Bill Johnston, TREB President

April 22, 2011 -- Condominium transactions (sales of condo apartments and condo townhouses combined) comprise approximately one in every three resale home transactions in the Greater Toronto Area compared to 25 years ago when condominiums comprised 25 per cent of the market.

There are many advantages to condo living including energy efficiency, proximity to amenities and maintenance free living. There is also a wider selection of condominium housing structures than ever before.

Regardless of the structure all condominium owners hold title to their units and share ownership and responsibility of and for the operating costs of the common elements that comprise the balance of the property.

Maintenance fees, which are paid in addition to your mortgage and property taxes, are directly related to the size of each condominium apartment unit.

While the maintenance fees may include the cost of heat, hydro, building insurance and upkeep of common areas, it is important to understand specifically what is covered in the maintenance fees.

Ask your REALTOR® for help in understanding what your fees will include in the particular condominium you're interested in buying.

Condominium townhouses may also involve maintenance fees. In this case, fees are related to common areas outside of the structure like Snow removal and lawn care.

There are a number of details involved in a condominium purchase that are unique to this housing type. As such, it's wise to work with a REALTOR®, regardless of whether you are buying a new or resale unit.

When buying a new condo unit, buyers should request a disclosure statement. It includes a description of the project's most important features, bylaws that govern the corporation, rules that regulate owners' living environments and the condominium corporation's budget for the first year after registration.

When buying a resale condo, buyers should also request a status certificate, which offers similar information and confirms that the owner is current with common expenses. It's important to speak with your REALTOR® and discuss which conditions are best suited for your offer.

The move-in date for a new condominium is referred to as an occupancy closing, which takes place until the condominium corporation is registered. Again, ask your REALTOR® to help you understand exactly what is and can be expected at closing.

A condominium Board of Directors, consisting of at least three Directors, is responsible for ensuring monies are held in trust, funds are properly invested and records are kept.

Owners meanwhile are responsible for ensuring their units are in good repair and must seek approval for structural changes within them.

To be sure that you are clear as to your responsibilities as a condominium buyer, be sure to talk to a Greater Toronto REALTOR® who can help you find a condominium ideally suited to your lifestyle. For more information visit www.TorontoRealEstateBoard.com

Bill Johnston is President of the Toronto Real Estate Board, a professional association that represents 31,000 REALTORS® in the Greater Toronto Area

Image Source Page: http://urbanrealtytoronto.com/wordpress/2010/08/18/toronto-hotel-boutique-condos-part-2/

Labels:

Aurora,

Coldwell Banker,

Darcy,

dream house,

Main Street,

Market Data,

newmarket,

Toombs,

Toronto Real Estate,

wealth

Tuesday, March 29, 2011

TV Show being filmed in Newmarket TODAY!

Today is the day that the USA network films a few shots of it's Show Covert Affairs.

Scenes will be shot in these three areas:

1. Travelling shots on Eagle street between Main and Yonge Street.

2. Filming at the intersection of Main St and Queen Street. (approx 7-9pm)

3. Filming in the Market Squarre Parking Lot (by the Public Library) (Approx 9-11pm)

For more info on the show, click on the following link: http://www.usanetwork.com/series/covertaffairs/

Labels:

canspec,

Covert Affai,

Darcy,

newmarket,

Toombs,

USA Network

Wednesday, March 23, 2011

The 1% solution: 5 tips to help sell your house

By Jennifer Wilson | Wed Mar 23 2011

Whether you’re moving out of town, moving up or splitting up, everyone has the same goal when they’re selling their home: to make as much as they can.

One way to get the best sale price is to invest a few dollars to spruce up your place for prospective buyers. One rule of thumb is that you should set aside 1 per cent of your asking price, so, if you’re listing for $400,000 a renovation budget of $4,000 isn’t out of line.

Of course, certain projects will get you more, though in most cases you won’t get all your money back. The return can be anywhere from nothing, for skylights and pools, to an average of 75 per cent on high-performing kitchens and bathroom projects.

Here are some tips:

Kitchen

You can expect to recover 75 to 100 per cent of your investment in kitchens and bathrooms.

“The payback is tremendous,” says Frank Turco, Home Depot’s trend and design manager. That’s because buyers don’t want to undertake a cumbersome renovation that restricts access to these key spaces.

A few hundred dollars can give your kitchen a whole new look. Cabinets can be cleaned, lightly sanded and painted to look like new, while hardware can also be updated quickly and inexpensively, with new pulls and handles starting at a few dollars a pop. Outdated track lights can be replaced with more fashionable varieties, focused task lighting and undercabinet lighting. Dingy backsplashes can also be refreshed with a coat of paint or new tiles, which are available in peel-and-stick varieties.

For a bit more of a splurge, try replacing laminate cabinets with wood and laminate countertops for something a higher end, such as Corian or granite. New appliances are also a worthy investment, with stainless steel and once again trendy glossy white appealing to buyers.

Bathrooms

In the bathroom, like the kitchen, painting the vanity, and swapping out light fixtures and pulls can refresh the space inexpensively. Upgrading faucets, taps and shower heads are another simple project in the $50 - $100 range.

Additional storage is also essential in the bathroom, so look into closet and cupboard organizing systems and adding extra shelving.

Or go all out and embrace the trend for more spa-like bathrooms with marble tiling, full glass showers with extra nozzles and high-end showerheads or a steam shower. Double sinks, heated floors and upgraded countertops are also nice perks.

Paint

In all spaces, a fresh coat of paint works wonders – bringing homeowners a return of 50 to 70 cents on the dollar, says says Mariano Gigante, a sales representative with Sutton Group. Others like, Re/Max salesperson Justin Kua estimate a fresh paint job can bring in returns of 300 per cent.

“Even if it is a simple thing to fix, buyers want it done,” says Gigante, noting it also helps sell homes quicker than other upgrades. Wipe away scuffed paint and outdated colours with neutral hues for a fresh, buyer friendly look.

Flooring

Ripping out worn carpets and refinishing, or replacing, battered floors can offer returns of 75 to 100 per cent, says Gigante, noting that laminate and wood offer the highest rate of return.

Turco recommends laminate vinyl options, explaining “vinyl has come a long, long way” and is now available in durable planks, tiles and sheets that can mimic almost any look and texture, with many varieties available in the $60 range for 24 square feet. Plus, as far as projects go, it’s “inexpensive and easy, as long as you have a box cutter and a ruler.”

Other upgrades

Replacing doors and windows can bring in 50 to 75 per cent – and help you save on energy costs to boot.

Landscaping, meanwhile, will put roughly 25 to 50 per cent of what you spend back into your pocket. A well-maintained garden, brick paths and even urns can also do a lot to boost your home’s curb appeal.

A buyer’s first impression is key so for an easy fix up under $100, Turco suggests cleaning up the front yard, repainting pots and planters, laying a new welcome mat and painting the front door.

Read about 10 easy ways to boost your home’s curb appeal here.

What not to do

Finishing a basement will see about a 50 per cent return on your investment, but as a big and costly job, Gigante says it’s only worthwhile if the homeowners intend on using it themselves for a while.

Skip the skylight. While additional natural light can be a boost, this project is expected to bring you absolutely no return, says Gigante.

Also avoid adding a swimming pool or Jacuzzi. It usually doesn’t improve your resale value and can even discourage buyers, such as families with small children.

If you are tackling a larger scale reno or working with a contractor, make sure the project comes in at less than your one per cent resale renovation budget, including a hefty contingency fund. The projects that offer the biggest returns – kitchens and bathrooms – can also bring the biggest surprises, snowballing costs as mechanical problems are uncovered.

Jennifer Wilson is the editor of yourhome.ca

Labels:

Coldwell Banker,

Conditional Sale,

Darcy,

GTA,

home,

House,

inspection,

invest,

Market Data,

newmarket,

reno,

Renovation,

Sales,

Sold,

Staging,

Toombs,

Toronto Real Estate,

wealth

Monday, March 21, 2011

VIVA Davis Drive Road Widening Lane Closures

Please see below for details regarding temporary lane closures on Davis Drive this week.

1) In front of 54 Davis Drive on the south side (east of Yonge Street), temporary lane closures of the eastbound curb lane.

• Dates: Tuesday, March 22 to Thursday, March 24

• Hours of work will be between 9:30am and 3:30pm

2) In front of 350 Davis Drive on the south side (west of Niagara Street), temporary lane closures of the eastbound curb lane.

• Dates: Tuesday, March 22 to Thursday, March 24

• Hours of work will be between 9:30am and 3:30pm

• Dates: Tuesday, March 22 to Thursday, March 24

• Hours of work will be between 9:30am and 3:30pm

Appropriate traffic control measures will be in place and every effort will be made to minimize any disruption to the traffic and pedestrians near the work area.

Labels:

Coldwell Banker,

commercial real estate,

Darcy,

newmarket,

Toombs,

Toronto Real Estate,

VIVA

Saturday, March 5, 2011

Monday, February 28, 2011

Tuesday, February 8, 2011

Roofing Red Flags - CBC Market Place

Click on the following link to watch a eye opening video on how some shady roofers pick your pockets:

Labels:

Aurora,

Darcy,

Ice damming,

inspection,

newmarket,

Toombs,

Toronto Real Estate,

wealth

Wednesday, February 2, 2011

Monday, January 17, 2011

New Mortgage Rules from the Department of Finance

The Harper Government Takes Prudent Action to Support the Long-Term Stability of Canada's Housing Market

The Honourable Jim Flaherty, Minister of Finance, and the Honourable Christian Paradis, Minister of Natural Resources, today announced prudent adjustments to the rules for government-backed insured mortgages to support the long-term stability of Canada’s housing market and support hard-working Canadian families saving through home ownership.

“Canada’s well-regulated housing sector has been an important strength that allowed us to avoid the mistakes of other countries and helped protect us from the worst of the recent global recession,” said Minister Flaherty. “The prudent measures announced today build on that advantage by encouraging hard-working Canadian families to save by investing in their homes and future.”

“The economy continues to be our Government’s top priority,” continued Minister Paradis. “Our Government will continue to take the necessary actions to ensure stability and economic certainty in Canada’s housing market.”

The new measures:

1. Reduce the maximum amortization period to 30 years from 35 years for new government-backed insured mortgages with loan-to-value ratios of more than 80 per cent. This will significantly reduce the total interest payments Canadian families make on their mortgages, allow Canadian families to build up equity in their homes more quickly, and help Canadians pay off their mortgages before they retire.

2. Lower the maximum amount Canadians can borrow in refinancing their mortgages to 85 per cent from 90 per cent of the value of their homes. This will promote saving through home ownership and limit the repackaging of consumer debt into mortgages guaranteed by taxpayers.

3. Withdraw government insurance backing on lines of credit secured by homes, such as home equity lines of credit, or HELOCs. This will ensure that risks associated with consumer debt products used to borrow funds unrelated to house purchases are managed by the financial institutions and not borne by taxpayers.

Our Government’s ongoing monitoring and sound underlying supervisory regime, along with the traditionally cautious approach taken by Canadian financial institutions to mortgage lending, have allowed Canada to maintain strong and secure housing and mortgage markets.

The adjustments to the mortgage insurance guarantee framework will come into force on March 18, 2011. The withdrawal of government insurance backing on lines of credit secured by homes will come into force on April 18, 2011.

The Full Article can be read at: http://www.fin.gc.ca/n11/11-003-eng.asp

The Honourable Jim Flaherty, Minister of Finance, and the Honourable Christian Paradis, Minister of Natural Resources, today announced prudent adjustments to the rules for government-backed insured mortgages to support the long-term stability of Canada’s housing market and support hard-working Canadian families saving through home ownership.

“Canada’s well-regulated housing sector has been an important strength that allowed us to avoid the mistakes of other countries and helped protect us from the worst of the recent global recession,” said Minister Flaherty. “The prudent measures announced today build on that advantage by encouraging hard-working Canadian families to save by investing in their homes and future.”

“The economy continues to be our Government’s top priority,” continued Minister Paradis. “Our Government will continue to take the necessary actions to ensure stability and economic certainty in Canada’s housing market.”

The new measures:

1. Reduce the maximum amortization period to 30 years from 35 years for new government-backed insured mortgages with loan-to-value ratios of more than 80 per cent. This will significantly reduce the total interest payments Canadian families make on their mortgages, allow Canadian families to build up equity in their homes more quickly, and help Canadians pay off their mortgages before they retire.

2. Lower the maximum amount Canadians can borrow in refinancing their mortgages to 85 per cent from 90 per cent of the value of their homes. This will promote saving through home ownership and limit the repackaging of consumer debt into mortgages guaranteed by taxpayers.

3. Withdraw government insurance backing on lines of credit secured by homes, such as home equity lines of credit, or HELOCs. This will ensure that risks associated with consumer debt products used to borrow funds unrelated to house purchases are managed by the financial institutions and not borne by taxpayers.

Our Government’s ongoing monitoring and sound underlying supervisory regime, along with the traditionally cautious approach taken by Canadian financial institutions to mortgage lending, have allowed Canada to maintain strong and secure housing and mortgage markets.

The adjustments to the mortgage insurance guarantee framework will come into force on March 18, 2011. The withdrawal of government insurance backing on lines of credit secured by homes will come into force on April 18, 2011.

The Full Article can be read at: http://www.fin.gc.ca/n11/11-003-eng.asp

Labels:

Aurora,

Coldwell Banker,

Darcy,

home,

House,

Market Data,

mortgage,

newmarket,

Toombs,

Toronto Real Estate,

TREB,

wealth

Saturday, January 15, 2011

Thursday, January 13, 2011

Subscribe to:

Posts (Atom)