Weekly updates of the Newmarket Real Estate Market and relavent information for Home Owners, Home Buyers, Tenants, Landlords, and Business Owners.

Monday, December 17, 2012

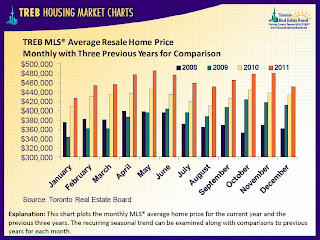

TREB President's message - New mortgage rules have affected home sales

December 14, 2012

A moderate number of resale home transactions took place throughout the Greater Toronto Area (GTA) in November, with 5,793 homes changing hands. This represented a 16 per cent decrease from 6,908 sales in November 2011.

In Toronto 2,308 transactions took place last month compared to 2,952 sales a year ago - a decline of nearly 28 per cent. Meanwhile 3,485 homes changed hands in the 905 Regions, a decrease of more than 13 per cent from 3,956 sales in November 2011.

A key factor that has influenced the dip in sales experienced in recent months relates to the changes in mortgage lending guidelines that came into effect in July. The changes reduced the maximum amortization period from 30 years to 25 years and set a purchase price ceiling for government backed insured mortgages at one million dollars. These regulations have resulted in some households putting their decision to purchase on hold while they save up more money for a down payment and/or experience an increase in their income. Adding to this situation in the City of Toronto is the additional upfront Land Transfer Tax, which takes money from home buyers that could otherwise be used to offset the high costs of home ownership.

While sales decreased year-over-year in November, a modest overall price increase was reported, with the average price of a GTA home reaching $485,328. This represented an increase of 1.6 per cent compared to a year ago.

The 905 Region, with an average price of $463,779, showed a price increase of four per cent compared to a half-percent decrease in the City of Toronto average home price, which was $517,866.

The pace of average price growth in November was slower than what was experienced for much of 2012, especially in the low-rise segment of the market. This was largely due to the fact that the mix of single detached homes sold in the City of Toronto this past November changed relative to last year. Specifically, the share of homes that sold for over one million dollars was down considerably.

While the mix of home types sold may have changed, market conditions remained tight for low-rise home types. This is evident when we consider the MLS® Home Price Index (HPI) for the GTA. The MLS® HPI tracks the price change for benchmark homes – in other words: a home with the same attributes over time. When we look at price through this lens, we find that the benchmark price for major home types was up by 4.6 per cent in the GTA as a whole and 3.9 per cent for the City of Toronto.

News on the employment front was positive in November, as the Toronto seasonally adjusted unemployment rate decreased to 8.2 per cent, from 8.6 per cent the previous month. Interest rates remain largely unchanged, with a five year fixed mortgage rate of just over three per cent continuing to be available.

At this time of year I am often asked whether it is prudent to list one’s home for sale over the holidays, and there are in fact, many benefits to doing so. Consider that those viewing homes at this time of year are more likely to be serious buyers. As well, homes often look their best when they are decorated for the holidays, and a favourable emotional response to a property often prompts an offer.

I encourage you to talk to a Greater Toronto REALTOR® about the many other factors you should consider before choosing to make your next move and in the meantime, be sure to visit www.TorontoRealEstateBoard.com for all of the latest updates on the market.

Ann Hannah is President of the Toronto Real Estate Board, a professional association that represents 35,000 REALTORS® in the Greater Toronto Area.

Article can be read here: http://communications3.torontomls.net/media_centre/star_column/index.htm

Monday, December 10, 2012

Should I sell my home During the Holidays?

Here is a great article for those thinking about putting their property on the market during the holiday season!

Enjoy!

http://online.wsj.com/article/SB10001424127887324640104578165580618753110.html

Labels:

Aurora,

Coldwell Banker,

Darcy,

Darcy Toombs,

darcytoombs.com,

dream house,

GTA,

Main Street,

Market Data,

planning,

Real Estate,

Sales,

Sold,

Toombs,

Toronto Real Estate,

TREB,

virtual Tour,

wealth

Thursday, December 6, 2012

November 2012 Real Estate Market update

Newmarket Real Estate Data

Average Price November 2012

November 2012Average Price: $439,470

Active Listing: 182

Sales/Month: 100

Sales/Active Listings: 54.95%

Sales/Year (to-date): 1,425

Volume of Sales

November 2011

Average Price: $427,706

Active Listings: 109

Sales/Month: 106

Sales/Active Listings: 97.24%

Sales/Year (to-date): 1,336

Prices are still historically high, but the concern is going to be whether the market will bear the high prices with stricter lending policies put in place by the federal government.

If there are more Buyers than Sellers, the market is good for Sellers and prices increase. But if Buyers are having a tougher time qualifying for financing, the Buyer pool becomes smaller than the Seller pool and simple economic, supply and demand law, will dictate that prices should decrease.

So, long and the short of it is this: The government is trying to curb consumer debt by making lending policies stricter, which should also put the brakes on housing prices continue to soar. I'm not saying the market is going to crash, especially since we are located in a great geographical location and have amazing services at our finger tips (thus creating an outside demand for our area), but Sellers need to understand that they might not sell their home for more than their neighbour did this year... the market is changing!

Let me know your thoughts!

Darcy Toombs

Labels:

Coldwell Banker,

Darcy,

Darcy Toombs,

darcytoombs.com,

dream house,

financing,

GTA,

home,

House,

Market Data,

TD Bank,

Toombs,

Toronto Real Estate,

TREB

Tuesday, November 27, 2012

YorkRegion Article: Newmarket courthouse expansion overdue: AG

The move comes after the ministry was criticized for refusing to add more courtrooms and associated staff, despite court times steadily increasing at the facility that serves all of York Region.

For full article, click here:

YorkRegion Article: Newmarket courthouse expansion overdue: AG

Labels:

Coldwell Banker,

construction,

Darcy,

Darcy Toombs,

darcytoombs.com,

GTA,

newmarket,

planning,

Toombs

Monday, November 12, 2012

Warriors win York Region Football title!

Huron Heights Warriors beat King City high to Win York Region Football Football title!

YorkRegion Article: Newmarket’s Huron Warriors fend off King City Lions for YRAA football title

YorkRegion Article: Newmarket’s Huron Warriors fend off King City Lions for YRAA football title

Friday, November 2, 2012

YorkRegion Article: Newmarket forgoes fees for farmers market

Click here for the story:

YorkRegion Article: Newmarket forgoes fees for farmers market

Good news Newmarket!

YorkRegion Article: Newmarket forgoes fees for farmers market

Good news Newmarket!

Thursday, October 25, 2012

10 Tips for Halloween Safety! - From The Fire Guy

Courtesy Canadian Red Cross The day that paranormal creatures invade city streets is near.

As your little ones prepare their costumes to trick or treat their way through the night, the Canadian Red Cross has prepared a quick list of 10 tips to make sure everyone gets home safely. You may not need to fear vampires and ghosts knocking on your door, but fire hazards, scrapes and getting lost are potential concerns.

1.

Give your kids a map of their trick or treat route so they can find

their way home. Mark the homes of nearby friends and relatives in case they

need assistance on their journey. Younger children should be chaperoned by an

adult.

2.

Instruct children to walk on the sidewalk not the street - even

princesses and fairies have to watch out for motorists!

3.

Prepare for the dark with lighter coloured clothing and reflective

surfaces. What better way to decorate a sword or a cape than with magical

glowing tape?

4.

Avoid any type of flame by substituting candles with glow sticks.

Wigs and costumes are highly flammable and glow sticks are perfect for

illuminating Jack-o-lanterns.

5.

Remind your kids to stick with groups of at least four or five -

after all, even legendary heroes are stronger as a team (like the Avengers and

X-Men!)

6.

Tell them to only visit residences with a porch light on and not to

enter a stranger’s home - politely accept candy and promptly leave.

7.

Costumes are meant to embellish - not to hide. Keep hems short to

avoid tripping and don’t let masks block the eyes.

8.

Whether you have one eye, two eyes, three eyes or four, always look

both ways before crossing the street.

9.

Both mystical creatures and children need to let parents check their

candy before eating to remove any potential hazards.

10.

A flashlight is akin to a protective light saber of sorts and makes night-time

travelling safer (it also helps you spot a ghost or goblin trying to plan a

surprise attack!)

Following

these tips on October 31 will help ensure your family has a fun and safe night

of trick or treating!

For all your

Retrofit needs remember The Fire Guy

"Who is here protecting you from Fire and Fire Departments"

"Who is here protecting you from Fire and Fire Departments"

Friday, October 19, 2012

VivaNext Construction update! Prospect South of Davis

|

|

|

|

|

Utility manhole

construction on Prospect Street south of Davis Drive

As part of the rapidway construction on Davis

Drive, a utility manhole will be constructed just south of Davis Drive on the

east side of Prospect Street.

Dates: Starting Monday, October 22 for approximately four weeks*

Times: 7am-5:30pm

Lane closure and work area

Crews will be working in the northbound curb lane on Prospect

Street around the Southlake Regional Health Centre parking garage entrance

(see map).

Sidewalk and bus stop information

Please note: There may be short-term noise disturbances and intermittent

vibration associated to this work.

If you have questions about the rapidway

project, please visit vivanext.com, or contact:

Michelle Dudzik Community Liaison Specialist Telephone: 905.886.6767 Ext.1096 Cell: 905.716.7663 Email: michelle.dudzik@york.ca *Please note: As with other road construction projects, some work will have traffic flow and noise impacts or may be rescheduled due to weather conditions and other variables. We are committed to providing advance notice whenever possible. |

Labels:

construction,

Darcy Toombs,

newmarket,

rapidway,

southlake,

VIVA

Wednesday, October 17, 2012

Mortgage Pre-Approvals... Not what they used to be.

I received an interesting email today from a Mortgage Broker, Darlene Hinton. Usually I disregard the bombardment of emails I get from Mortgage Brokers, but the first line really caught my attention since I have one property which I have now sold three times because the Buyers financing on the first two deals fell apart before the removal of the financing condition.

Mortgage Pre-approvals are not what they used to be. In times past, a client could depend on a bank's word when they gave them preapproval to start shopping. That's just not the case anymore. I see it all the time. . . clients happily shopping (and putting in an offer to purchase) confident they were golden with their bank. . . only to find there was some glitch. There are too many to list, but it could be something as inane as the address of the property the client wants to buy or an issue with the source of a client's downpayment. Maybe the clients credit rating drops between Pre-approval and Offer to Purchase. It could be anything.

--

DARLENE HINTON

Mortgage Pre-approvals are not what they used to be. In times past, a client could depend on a bank's word when they gave them preapproval to start shopping. That's just not the case anymore. I see it all the time. . . clients happily shopping (and putting in an offer to purchase) confident they were golden with their bank. . . only to find there was some glitch. There are too many to list, but it could be something as inane as the address of the property the client wants to buy or an issue with the source of a client's downpayment. Maybe the clients credit rating drops between Pre-approval and Offer to Purchase. It could be anything.

Many of these issues can be avoided by using a Broker who

takes the time to establish a personal relationship with their client. I

try to gather every fact I can so as to avoid unneccesary stress and

disappointment. But perhaps even more importantly. . . I have access to a

plethora of Lenders that would be happy to step in should a Lender get cold

feet.

Do you want to save both yourself and your client

precious time? Call me for your homebuyers financng. . .and let's

close more deals. . faster and more

efficiently. :)

Call me. I can help.

--

Mortgage Agent

Touch Residential Capital

License #M10001367

Phone: 705-331-6774

Fax: 1-866-716-7038

Labels:

Aurora,

Darcy Toombs,

financing,

mortgage,

newmarket,

Real Estate

Tuesday, July 3, 2012

Weekend GoTrain Service to Newmarket/Aurora!

If you didn't know, it is now possible to catch the GoTrain to and From Toronto in Newmarket/Aurora on weekends and Holidays.

Between June 23, 2012 and September 3, 2012, GoTransit (Government of Ontario Transit) is doing a pilot GoTrain schedule along the Barrie line.

My guess is that they will continue if they see the usage, but it appears to be here just for the Summer (for now).

Here is some details on the Service:

It appears that there will be 2 trains that will do the entire route from Barrie to Toronto and run up and down all day, 6 times. However, will only run all the way to Barrie twice, stopping and turning around at the East Gwillimbury Station on Green Lane 4 of the 6 times.

This train line services: Allandale go Station (Barrie) -> Barrie South Go station -> Bradford Go Station -> East Gwillimbury (EG) Go Station -> Newmarket GoTrain Station -> Aurora Go Station -> King City Go Station -> Maple Go Station -> Rutherford Go Station -> York University Go Station -> Union Station (Toronto)

1:20pm departure - EG Station (Green Lane/Main St North) -> Toronto - 2:21pm arrival

4:12pm departure - EG Station -> Toronto - 5:13pm Arrival

5:00pm departure - Barrie Allandale Station -> Toronto - 6:38pm arrival

8:00pm departure - EG Station -> Toronto - 9:01pm Arrival

10:22pm departure - EG Station -> Toronto - 11:56pm arrival

3:01pm departure - Toronto -> EG Station - 4pm arrival

5:25pm departure - Toronto -> Barrie Allandale Station - 7:02pm arrival

6:50pm departure - Toronto -> EG Station - 7:49pm arrival

9:41pm departure - Toronto -> EG Station - 10:40pm arrival

12:10am departure - Toronto -> Barrie Allandale Station - 1:45am arrival

to view the complete schedule, click on the following link:

http://www.gotransit.com/publicroot/en/PDF/Timetables/CurrentBoard/Table65.pdf

I'll be sure to follow how well this pilot program goes as I believe better train service to Newmarket/Aurora will be well used in the coming years.

Lets see a few more trains during the work week too!

Between June 23, 2012 and September 3, 2012, GoTransit (Government of Ontario Transit) is doing a pilot GoTrain schedule along the Barrie line.

My guess is that they will continue if they see the usage, but it appears to be here just for the Summer (for now).

Here is some details on the Service:

It appears that there will be 2 trains that will do the entire route from Barrie to Toronto and run up and down all day, 6 times. However, will only run all the way to Barrie twice, stopping and turning around at the East Gwillimbury Station on Green Lane 4 of the 6 times.

This train line services: Allandale go Station (Barrie) -> Barrie South Go station -> Bradford Go Station -> East Gwillimbury (EG) Go Station -> Newmarket GoTrain Station -> Aurora Go Station -> King City Go Station -> Maple Go Station -> Rutherford Go Station -> York University Go Station -> Union Station (Toronto)

South Bound Service:

10:20am departure - Barrie (Allandale Go Station) -> Toronto (union Station) - 11:58am arrival1:20pm departure - EG Station (Green Lane/Main St North) -> Toronto - 2:21pm arrival

4:12pm departure - EG Station -> Toronto - 5:13pm Arrival

5:00pm departure - Barrie Allandale Station -> Toronto - 6:38pm arrival

8:00pm departure - EG Station -> Toronto - 9:01pm Arrival

10:22pm departure - EG Station -> Toronto - 11:56pm arrival

Northbound Service

12:10pm departure - Toronto (Union) -> EG Station - 1:09pm arrival3:01pm departure - Toronto -> EG Station - 4pm arrival

5:25pm departure - Toronto -> Barrie Allandale Station - 7:02pm arrival

6:50pm departure - Toronto -> EG Station - 7:49pm arrival

9:41pm departure - Toronto -> EG Station - 10:40pm arrival

12:10am departure - Toronto -> Barrie Allandale Station - 1:45am arrival

to view the complete schedule, click on the following link:

http://www.gotransit.com/publicroot/en/PDF/Timetables/CurrentBoard/Table65.pdf

Newmarket Southbound trains (GoTrain station @ Davis Drive/Superior [Tannery Mall]):

11:00am; 1:23pm; 4:15pm; 5:40pm; 8:03pm; 10:58pmAurora Southbound Trains (Aurora GoTrain Station on Wellington):

11:06am; 1:29pm; 4:21pm; 5:46pm; 8:09pm; 11:04pmI'll be sure to follow how well this pilot program goes as I believe better train service to Newmarket/Aurora will be well used in the coming years.

Lets see a few more trains during the work week too!

Labels:

Aurora,

Coldwell Banker,

Daniel Craig,

Darcy,

GoTrain,

newmarket,

Toombs,

Toronto Real Estate

Thursday, May 31, 2012

Increasing your payment by a small amount can yield huge savings.

As you know, you're paying interest every day

you have a mortgage. So the sooner you reduce the amount you owe, the less

interest you pay. One relatively painless way to do this is by increasing your

payment by a small amount. Then all you have to do is sit back and let time

work it's magic—before you know it, you'll have chipped thousands of dollars

off your mortgage!

Let's say you have a $200,000 mortgage at 4.5% with a 30 year amortization, and

you're in year 3. If you increase your monthly payment by $100—roughly the cost

of one premium coffee per day—that reduces your amortization by 51 months and

saves you $24,622 in interest over the life of the mortgage! Now, I'm not

suggesting you give up all of life's pleasures to pay off your mortgage faster.

But it's obvious that doing something small can make a BIG difference.

Information is compliments of:

Mike Havery AMP, Mortgage Planner

http://www.themortgagearchitect.ca/

Information is compliments of:

Mike Havery AMP, Mortgage Planner

http://www.themortgagearchitect.ca/

Labels:

Aurora,

Coldwell Banker,

Darcy,

home,

invest,

Market Data,

mortgage,

newmarket,

RBC,

RRSP,

Sales,

Toombs,

Toronto Real Estate,

TREB,

wealth

Tuesday, May 22, 2012

Demand for Luxury homes on the rise across Canada

Sales of luxury homes have started out at a record-setting pace for 2012, up almost 50 per cent over the first quarter of last year, according to a new ReMax report.

While the luxury market only accounts for about 2 per cent of the total GTA housing market, the unexpectedly strong demand, coupled with a

“severe shortage” of prime properties in higher-end neighbourhoods, is only further fuelling bidding wars and price escalations, it says.

That, in turn, is driving more properties into the “luxury” price range. Even suburban communities such as Vaughan, Markham and Richmond Hill have seen a 54 per cent jump in demand for $1.5 million-plus homes in the first quarter of 2012 over 2011.

But that translates into just 54 luxury homes changing hands in those communities, it’s important to note, up from 35 sales in the first quarter of last year.

The annual report, Upper-End Market Trends 2012, examines prices and trends across Canada, prime neighbourhood by prime neighbourhood.

Luxury sales records were set in 10 of the 16 urban markets the report tracks, although the definition of luxury can vary from $500,000 (in mid-sized markets such as Regina and Halifax) up to $2 million (Greater Vancouver.)

Some 412 homes sold for over $1.5 million from January to the end of March across the GTA, up from 277 during the same time last year, the report says.

While high-end demand in Toronto was hot — especially in neighbourhoods within walking distance of transit — things have cooled in Vancouver where last year a frenzy of foreign buyers not only drove up sales numbers, but skewed average house prices upward right across the country before the buying frenzy eased later in 2011.

Low interest rates, improving consumer confidence and “tremendous confidence in the city’s residential housing market” in the face of stock market and global economic turmoil, are all being cited as factors. But, even then, the sales figures came as a surprise, says Michael Polzler, executive vice president for ReMax Ontario-Atlantic Canada.

“We didn’t expect (luxury sales) to be up nearly this much. This is significant.

“I think there is a lot of momentum out there in the market and people want to buy. If anything, in many cases, there is a shortage of product.”

That shortage is being felt even in the condo sector, Polzler said.

Seven per cent of luxury sales were condos in Toronto’s pricey core, the report notes, most of them in Yorkville.

The highest-priced condo sold in Toronto so far this year went for $5.3 million — a far cry from the record $28 million spent by an international buyer last year for a penthouse, due to be completed this summer, in the new Four Seasons Private Residences and hotel towers.

Regina, where luxury comes in at $500,000 or more, saw the biggest increase in luxury sales this year, up 56 per cent over the first quarter of 2011.

More: New home prices continue to rise

More: Things to watch for when flipping a condo

]]> http://www.moneyville.ca/article/1179107--demand-for-high-priced-homes-up-across-canada

Labels:

Aurora,

Coldwell Banker,

Darcy,

darcytoombs.com,

GTA,

House,

Market Data,

newmarket,

Toombs,

Toronto Real Estate,

TREB

How to Avoid renting to a Problem Tenant!

A recent Toronto Star story exposed a problem tenant successful in abusing the Ontario landlord and tenant process to avoid paying rent. It can take landlords up to nine months to evict these types of ‘professional’ tenants.

However, it would be wrong to paint all tenants with the same brush. Over 95 per cent of Ontario tenants pay their rent on time and take care of their rental units. For every problem tenant, there are also problem landlords who do not properly maintain their buildings.

Here is how landlords and tenants can avoid problems:

Qualify your tenant in advance

When you advertise for a tenant, make it clear that you will be doing a credit check and checking personal references. This will assist in discouraging potential scammers.

Related: Why month to month may be better than a lease

Ask for a pay stub or banking information. Make sure that the proposed tenant makes regular deposits into their bank account, to prove steady employment.

Call references to make sure they check out

Google the tenant’s name to see if their social media information is the same as that on your rental application

Make sure the address on their driver’s license matches where they say they live now.

Join a service such as tenantverification.com to check a tenant’s credit

Have the tenant pay for utilities, if separately metered. They will have to pass the credit check of the utility company as well.

Treat tenants with respect

Successful investors understand that tenants are your silent partners. They are a source of income and are looking after your investment. When you treat them with respect, and show appreciation, they will also take better care of your building.

Something as simple as agift card can go a long way. When the tenants leave, if they have been a model tenant, why not award them with a certificate of superior tenancy, to show your appreciation. This might help them find another unit, especially if they have other credit problems.

Related: When can you evict a tenant for a family member?

If things go wrong, it is better to make a deal

Sometimes bad things happen. A tenant loses their job and even though they would like to pay the rent, they can’t. Instead of rushing to the landlord and tenant board, which takes time and results in hard feelings, try to work it out.

Perhaps offer to help the tenant move back with relatives and forgive part or all of the back rent owed, in exchange for the tenant leaving early. Let the tenant know that if they agree, you will also not notify the credit bureau about this and ruin their credit rating.

The landlord can then write off the amount owing and find another tenant to take over the unit. Also, when a deal is made, the tenant is likely not to damage the unit when they leave, which is what usually happens when things end badly.

Tenants, also show appreciation to those landlords who do properly look after your buildings. Don’t change the locks without permission, or permit visitors to damage anything on the property.

When landlords and tenants work together, everyone wins.

Mark Weisleder is a Toronto real estate lawyer. Contact Mark at mark@markweisleder.com

]]> http://www.moneyville.ca/article/1179318--how-to-avoid-renting-to-a-tenant-from-hell

Wednesday, April 25, 2012

Friday, April 20, 2012

Closing on June 29??? Might want to try another date

I got this email today and wanted to share it with everyone!

REALTOR WARNING RE: CLOSINGS ON JUNE 29, 2012

All realtors are aware that the end of June (after schools close for the summer) is the busiest closing time of the year.

Typically, at a month’s end, real estate closings are spread between the last FRIDAY of a month and the last business day of a month PLUS the first business day of the following month. In 2012, at the end of June, the last FRIDAY is the SAME day (June 29) as the last business day of the month being before a long weekend. Therefore, few buyers and sellers closing in the end of June will want a month’s end closing day to be prior to June 29 or after the long weekend (Monday, July 3 will be the holiday and the land registry system will be closed).

THE PROBLEM is that with most buyers and sellers wanting to close at end of June on one day, FRIDAY, June 29, 2012 (being the last business day of June and being the last FRIDAY before a long weekend), the possibility of many closing failing to occur on such a date increases due to delays in getting mortgage advances for buyers which will have a chain reaction causing delays to other closings. Inevitably, many closings will occur very late in the day on June 29, if they do close.

• If people are trying to move using elevators in condo buildings (or moving out of a rental unit)...

GOOD LUCK!

• Moving vans will all be fully booked... WATCH OUT!

• Mortgage lenders will NOT be able to process mortgage advances adequately due to the heavy month’s end volume.

• Lawyers will be scrambling for late deliveries of closing packages to get deals closed and roads will be clogged (delaying deliveries of closing packages) as people try to escape the big city for the long weekend after school is out.

SUGGESTION: Recommend to your buyers and sellers NOT to select June 29, 2012 as the closing date.

Selecting any other date would be much more reliable as a closing day.

My website www.home-legal-cost.com allows anyone to print out legal fees and disbursements by clicking on QUOTATION for any purchase or sale price under $1.5 million. See our 8 Toronto area law office locations specializing in residential real estate closings at www.home-legal-cost.com. For questions, call me to 11pm 7 days at (416) 520-6120.

Regards,

STEPHEN SHUB

Stephen H. Shub Professional Corporation

Barrister, Solicitor, Notary

8 Toronto Area Law Offices with

34 staff serving you in many languages

www.home-legal-cost.com

Cell 416-520-6120

(to 11pm 7 days)

Labels:

Coldwell Banker,

Darcy,

darcytoombs.com,

home,

Market Data,

planning,

Toombs,

Toronto Real Estate,

TREB,

wealth

Saturday, April 7, 2012

Aurora/Richmond Hill Stats (3/31/2012 - 4/06/2012)

To show why Newmarket's market seems to be so hot, we need to look to the south to see whats been going on there.

Avg. % of List: 102.11%

# of sales: 18

Avg. Day's on Market (DOM): 18

Average Sale Price: $724,484

Avg. % of List: 101.96%

# of sales: 68

Avg. Day's on Market (DOM): 11

As you can see, the markets to the South make Newmarket look affordable for most, which is why we are seeing many of the buyers coming from the south and driving up the prices.

I have said it before, and Ill say it again, I do not forsee a dramatic crash in the market, simply due to the population growth and the demand for housing. Restrictions, such as Oak Ridges Moraine and the Ontario Greenbelt has meant that Urban Sprawl is coming to an end and intensification and infill development is the next move.

* All data from the Toronto Real estate Board

Aurora:

Average Sale Price: $530,483Avg. % of List: 102.11%

# of sales: 18

Avg. Day's on Market (DOM): 18

Richmond Hill:

Average Sale Price: $724,484Avg. % of List: 101.96%

# of sales: 68

Avg. Day's on Market (DOM): 11

As you can see, the markets to the South make Newmarket look affordable for most, which is why we are seeing many of the buyers coming from the south and driving up the prices.

I have said it before, and Ill say it again, I do not forsee a dramatic crash in the market, simply due to the population growth and the demand for housing. Restrictions, such as Oak Ridges Moraine and the Ontario Greenbelt has meant that Urban Sprawl is coming to an end and intensification and infill development is the next move.

* All data from the Toronto Real estate Board

Labels:

Aurora,

GTA,

home,

House,

Market Data,

newmarket,

Sold,

Toronto Real Estate,

TREB

The last 7 days in Newmarket Real Estate (March 31 - Apr 6, 2012)

Well, the past week has been very similar to the week before!

In Newmarket, there were 34 Solds, ranging from $285,000, for a Tidy 2 bedroom Century Semi in the old downtown area, all the way up to $804,000, for a large 4-Bedroom Wyndam Village home.

Average Sold price was $492,640 while the sold price as a percentage of list price worked out to be a 101.91%. 2 listings, one of which was mine, sold for 111% of asking!

The stat that amazed me the most this past week was which area of town had the most action... Stonehaven -Wyndam Village, with 8 sales, followed by Woodland Hill (New area behind Walmart) with 7 sales.

Take a look at the stats for more info!

Labels:

Coldwell Banker,

Conditional Sale,

Darcy,

darcytoombs.com,

home,

Market Data,

newmarket,

Toombs,

Toronto Real Estate,

TREB,

wealth

Thursday, March 29, 2012

The past week in Newmarket Real Estate (March 22, 2012 - March 29, 2012)

It's amazing what is happening here and hard to keep up with it.

In the past 7 days*, there have been 32 reported sales in Newmarket, ranging from $296,000 to $872,000, with an average of $504,522.

What I consider to be the most amazing sales figure is the percentage of list price. The average of the 32 homes sold in the past 7 days was 101.47% of asking! In one case, a property in the Leslie Valley/Huron heights area sold for 116% of asking @ $497,000, which was $68k over asking.

With the rapid sales, and what some are considering outrageous prices for homes in areas that do not normally achieve such premiums, I am a little concerned about buyers purchasing homes that have less than 25% down, because a more thorough appraisal might have to be done and if the banks loan-value ratios don't match what the buyer offered to pay, then, the buyers will be required to come up with more money to close the deal... As a Realtor working for sellers, I will be ensuring I get a hefty deposit so that the buyers have no option to not close.

I want to close though with this. Newmarket/Aurora is a fantastic place to live and the buyers seem to be coming from the south, likely due to the prices being cheaper than Toronto/Richmond Hill/Vaughan, and as long as the immigration and population figures continue to grow, I'm not sure we will see a drastic drop in the prices... The demand seems to be there, and the option of renting just doesn't seem to be a better choice right now.

*as reported at 12:05pm March 29, 2012

In the past 7 days*, there have been 32 reported sales in Newmarket, ranging from $296,000 to $872,000, with an average of $504,522.

What I consider to be the most amazing sales figure is the percentage of list price. The average of the 32 homes sold in the past 7 days was 101.47% of asking! In one case, a property in the Leslie Valley/Huron heights area sold for 116% of asking @ $497,000, which was $68k over asking.

With the rapid sales, and what some are considering outrageous prices for homes in areas that do not normally achieve such premiums, I am a little concerned about buyers purchasing homes that have less than 25% down, because a more thorough appraisal might have to be done and if the banks loan-value ratios don't match what the buyer offered to pay, then, the buyers will be required to come up with more money to close the deal... As a Realtor working for sellers, I will be ensuring I get a hefty deposit so that the buyers have no option to not close.

I want to close though with this. Newmarket/Aurora is a fantastic place to live and the buyers seem to be coming from the south, likely due to the prices being cheaper than Toronto/Richmond Hill/Vaughan, and as long as the immigration and population figures continue to grow, I'm not sure we will see a drastic drop in the prices... The demand seems to be there, and the option of renting just doesn't seem to be a better choice right now.

*as reported at 12:05pm March 29, 2012

Labels:

Coldwell Banker,

Conditional Sale,

Darcy,

darcytoombs.com,

dream house,

GTA,

home,

House,

Market Data,

mortgage,

newmarket,

Toombs,

Toronto Real Estate,

TREB,

wealth

Tuesday, March 13, 2012

The past 10 days in Newmarket Real Estate

The past 10 days have been very active for home sales in Newmarket. The Toronto real Estate Board (TREB) has reported 45 homes sold in Newmarket, ranging from a 3 bedroom semi with a basement apartment for $311,000 ($11,100 over the $299,900 asking price) all the way up to a near 3/4 acre 4-bedroom Estate home which sold for $1,310,000.

The past 10 days have been very active for home sales in Newmarket. The Toronto real Estate Board (TREB) has reported 45 homes sold in Newmarket, ranging from a 3 bedroom semi with a basement apartment for $311,000 ($11,100 over the $299,900 asking price) all the way up to a near 3/4 acre 4-bedroom Estate home which sold for $1,310,000.The amazing part of all this is that the time at which it is taking to sell these properties. The median (the number in the middle of all the numbers) days on market was 10 days, while the Mode ( The mode is the number that is repeated most often ) was 7. What this means is that the majority of homes are selling fast! It's a great time to be a seller, provided you price your property with the market. The lack of inventory, so far this year, has really started the market off to a record breaking start. The Average price in February 2012 was $445,799, compared to the $392,892 in February 2011!

It's a different story if you are a buyer right now though as you may have to get your self into competition over a property with other buyers. The average sale price has been 99.39% of asking, while the highest percentage of list in the past 10 days was 108%!!!

Buyers and agents need to be educated on values, but also should be careful not to offer more than a home is really worth. For buyers who require high ratio financing you need to remember that a lender must still approve not only you, but ensure the home is worth what you are paying for it. If a home does not appraise out for what you are offering, you could get into a very sticky situation if you remove your financing condition before the bank appraises the property.

It's hard to say which way our local market is going, but from what I can see, it looks like there are more and more buyers moving north from southern communities based on a lot of the buyers agents office locations... Being a very nice and tidy community in the northern GTA that has some of the most "affordable" real estate prices must have a lot to do with it.

*All the data provided came from a search of sales on TREB of Residential sales that were reported within the past 10 days. For more info on Mode/Median/Average

Labels:

cash,

Coldwell Banker,

Conditional Sale,

Darcy,

invest,

Market Data,

newmarket,

Toombs,

TREB

Wednesday, January 11, 2012

December 2011 Market Stats - Annual Recap

Labels:

Aurora,

Coldwell Banker,

Darcy,

darcytoombs.com,

energy star;,

GTA,

home,

House,

Main Street,

Market Data,

mortgage,

newmarket,

Sales,

savings,

Sold,

TD Bank,

Toombs,

Toronto Real Estate,

TREB,

wealth

Location:

Newmarket, ON, Canada

Subscribe to:

Posts (Atom)